Over the years I have watched the Uranium spot price fluctuate and then as the tsunami hit japan not only did it effect Uranium it hit my whole portfolio. This point in history for me was the indicator at how fragile our global economy had become. It also showed how interlinked we all are even if a crisis is happening half way around the world.

The tsunami came at a time when some countries were switching to a high ratio of nuclear power on their grid while others seemingly wanted to eliminate it all together for fear of a meltdown. Suddenly the opponents to nuclear power had some ammunition and went to war on why we should all look to a safer alternative like solar or wind power.

Until recently I had not realized that some communities that rely on solar power have back up gas plants at the ready in case there is no wind and the solar stations do the same for those cloudy days. So there is a real false facade around green energy it its totality. With countries like China eating through resources at an alarming rate can you see them embracing massive wind farms that may go dead for days at a time when there is no wind? I think the facts speak for themselves when it comes to seeking out a clean energy source that has a high output capacity. A lot of scientist claim nuclear energy is the cleanest energy readily available and that one day it will dominate 90% if not 100% of the power production.

Now some scientists are looking into new ways to deal with the waste products that come out of nuclear power plants. The waste could possibly be reused by a more sophisticated nuclear plant that uses the waste as fuel. Even though the global stockpile of waste is very, very small according to experts.

Who uses nuclear power?

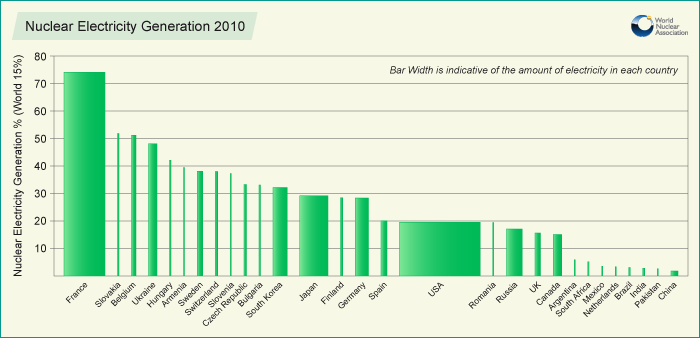

Over 13% of the world's electricity is generated from uranium in nuclear reactors. This amounts to over 2500 billion kWh each year, as much as from all sources of electricity worldwide in 1960.It comes from some 440 nuclear reactors with a total output capacity of about 377 000 megawatts (MWe) operating in 30 countries. Over 60 more reactors are under construction and another 150 are planned.

Belgium, Bulgaria, Czech Republic, Finland, France, Hungary, Japan, South Korea, Slovakia, Slovenia, Sweden, Switzerland and Ukraine all get 30% or more of their electricity from nuclear reactors. The USA has over 100 reactors operating, supplying 20% of its electricity. France gets three quarters of its electricity from uranium. The strongest supporters for nuclear power may be the scientists speaking around the world about global warming.

This leads me to some market ideas into 2014 and beyond. We all have to remember that the markets are always forward looking. Most institutional investors I know put their money where they feel the demand will be in the future and not what's the most popular right now. I think most investments ideas should be treated the same way in my opinion.

Conversely if China announces they overstated their uranium reserves and are planning on opening dozens of nuclear power plants then guess what? Uranium is probably not going to stay down at these levels forever. The Chernobyl disaster is widely considered to have been the worst nuclear power plant accident in history, and is one of only two classified as a level 7 event (the maximum classification) on the International Nuclear Event Scale (the other being the Fukushima Daiichi nuclear disaster in 2011). Thirty one deaths are directly attributed to the accident, all among the reactor staff and emergency workers. An UNSCEAR report places the total confirmed deaths from radiation at 64 as of 2008. So the worst disaster in history may have only killed 64 people and some may have died years later. Tell me again why nuclear power is unsafe? I think someone should display a total of how many man hours these plants around the globe have been operating safely. I know every hear I hear about hydro workers getting hurt or killed near live wires. How safe is that?

So by now you have figured out I am very pro nuclear power and since I can't run out and buy shares in a running power plant I am looking at investing in someone who can possibly supply the industry for decades to come.

Anfield Resources acquires strategic US uranium assets; aiming to become near-term uranium producer to complement its current copper production

These assets consist of 26 mining claim groups representing 133 unpatented mining claims on federal land located pursuant to applicable law. Within each of the Utah districts of San Juan County where property was acquired, there has been historical uranium production. Moreover, in some cases, the acquired properties themselves not only include past-producing uranium mines but also sit in close proximity to currently-producing uranium mines. Finally, all of the acquired assets within San Juan County, Utah are within a 75-mile radius of Energy Fuels Inc.’s White Mesa mill, the only operating conventional uranium mill in the US.“The strategy of Anfield Resources is to acquire strategic resource assets – on a commodity-agnostic basis – which can generate near-term revenue and cash flow,” commented Anfield CEO Corey Dias. “We believe that these uranium assets fall within the purview of that strategic focus. In fact, we will largely be following the same approach that has proved successful at our copper asset in Chile, whereby we provide raw material to a third-party processing plant, or mill, in exchange for a discounted price. Typically, the biggest hurdles facing junior mining companies relate to the expense involved in finding a way to process their raw materials. Therefore, by acquiring resource assets in close proximity to a functioning processing facility we are able to avoid the hurdles facing the vast majority of junior mining companies. We know that uranium mills will be looking for raw materials, especially given the impending expiration of the HEU agreement between Russia and the US this November. This factor, combined with the number of nuclear reactors proposed, planned or under construction worldwide, point to a shortfall in uranium raw materials, and represents a tremendous opportunity for Anfield”.

About Anfield Resources Inc.

Anfield is a publicly traded corporation listed on the TSX-Venture Exchange (EQX-ARY-V) and is engaged in mineral exploration, development and production in the United States and Chile. Its focus is on acquiring and developing an array of strategic mineral projects, including further developing its nascent copper production operation in Chile and its uranium assets in Utah and Arizona, and its longer-term focus on the development of its Arizona-based copper properties.

To find out more about Anfield, visit its website at www.anfieldresources.com.

Demand Forecast

Global uranium demand will probably rise 48 percent by 2023, according to the World Nuclear Association. Sixty-eight reactors are under construction, including 28 in China, 10 in Russia, 7 in India and 5 in South Korea, according to the WNA. About 435 reactors around the world with combined capacity of more than 370 gigawatts already consume about 78,000 tons of uranium concentrate annually, the association said.

In the wake of the 2011 nuclear disaster, Japan idled its 50 remaining reactors and Germany immediately shut some of its 17 plants.The spot price of uranium, which climbed as high as $138 per pound in June 2007, dropped to as low as $34.50 two months ago and recently held at $35.75, according to the Metal Bulletin.

“That doesn’t seem to reflect a lasting market trend as prices for long-term contracts are higher,” at about $54, Wantz said. Prices will also get a boost as uranium supplied from reprocessed nuclear weapons under a U.S.-Russian agreement will no longer be available.

http://www.bloomberg.com/news/2013-10-06/areva-urges-clients-to-buy-uranium-as-price-rebounds.html

About Anfield Resources Inc.

Anfield is a publicly traded corporation listed on the TSX-Venture

Exchange (EQX-ARY-V) and is engaged in mineral exploration, development

and production in the United States and Chile. Its focus is on acquiring

and developing an array of strategic mineral projects, including

further developing its nascent copper production operation in Chile and

its uranium assets in Utah and Arizona, and its longer-term focus on the

development of its Arizona-based copper properties. To find out more

about Anfield, visit its website at www.anfieldresources.com.

Read more at http://www.stockhouse.com/news/press-releases/2013/10/30/anfield-resources-acquires-strategic-us-uranium-assets;-aiming-to-become-near#7QtreZA0eHRflwpy.99

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.